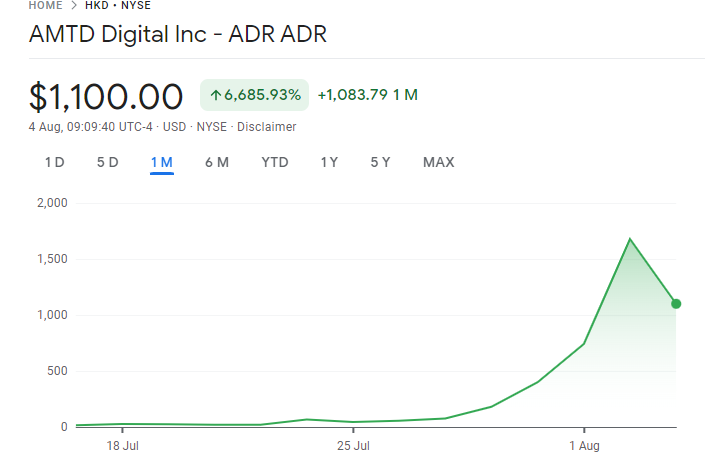

Hong Kong-based AMTD Digital listed on the Nyse on 15 July at a worth of $7.80 a share. Within the weeks since, it has seen the worth rocket to $1,679, giving it a market capitalisation of greater than $310 billion.

The corporate, a subsidiary of funding holding agency AMTD Thought Group that gives a “complete one-stop digital options platform” for the FS sector, made $25 million in revenues final yr.

It has turn out to be probably the most traded shares on retail platforms, with its rise in comparison with the Reddit WallStreetBets frenzy of final yr, which noticed shares in GameStop and AMC rocket.

Nonetheless, on the subreddit, posters have taken offence to the concept that they’re behind the AMTD Digital worth rise, with some speculating that it’s the truth is a “Chinese language rip-off”.

In the meantime, the corporate seems to be at midnight, issuing an announcement thanking buyers however admitting there isn’t a good motive for the surge.

“Through the interval since our preliminary public providing, the Firm famous important volatility in our ADS worth and, additionally noticed some very energetic buying and selling quantity.

“To our data, there aren’t any materials circumstances, occasions nor different issues regarding our Firm’s enterprise and working actions because the IPO date.”

,In what seems to be a GameStop-style retail investor-frenzy, shares in a little-known Asian fintech have soared greater than 21,000% since its IPO lower than a month in the past, making it extra invaluable than Financial institution of America.,