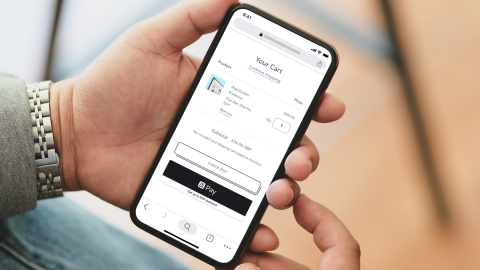

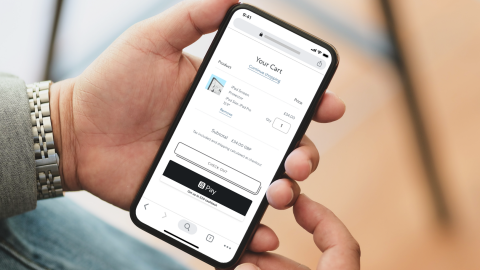

UK and EEA retailers can now current ‘Revolut Pay’ as a cost methodology – alongside the likes of PayPal and Apple Pay – throughout product, cart, and checkout pages. Shopify, Prestashop, WH Smith and Funky Pigeon are already onboard.

Current Revolut customers can use Revolut Pay and pay by way of saved playing cards or instantly by way of their account steadiness. Non-Revolut customers pays through the use of saved Mastercard or Visa playing cards issued by every other suppliers.

Funds will likely be validated by way of options similar to Face ID, or fingerprint unlock, and no account quantity will likely be shared.

The e-commerce play comes months after Revolut made its transfer into in-person funds with the launch of a card reader cost terminal.

Nikolay Storonsky, CEO, Revolut, says: “With its velocity, comfort, safety and low pricing, Revolut Pay offers retailers a aggressive benefit in a quickly rising e-commerce market.

“At Revolut, we always attempt to make it sooner, simpler and cheaper for retailers of all sizes to simply accept funds, wherever they’re, and to make it extra handy and safe for patrons to pay.”,Fintech superapp Revolut is taking over PayPal with its personal one-click cost checkout function for on-line purchases.,